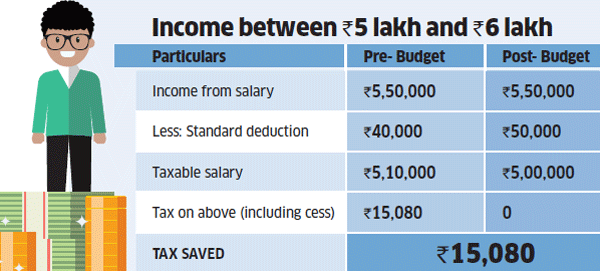

Budget 2019: Income above Rs 5 lakh? Tax relief calculation for income exceeding exemption amount; Find out | The Financial Express

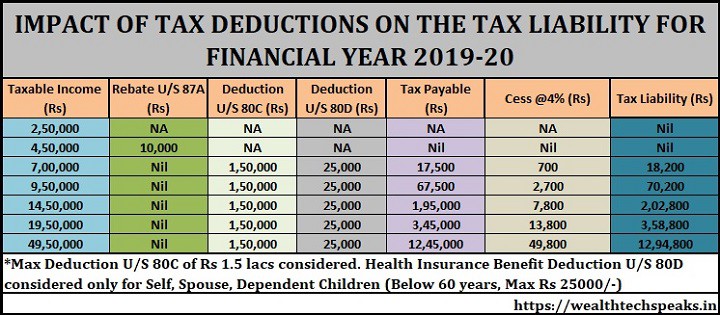

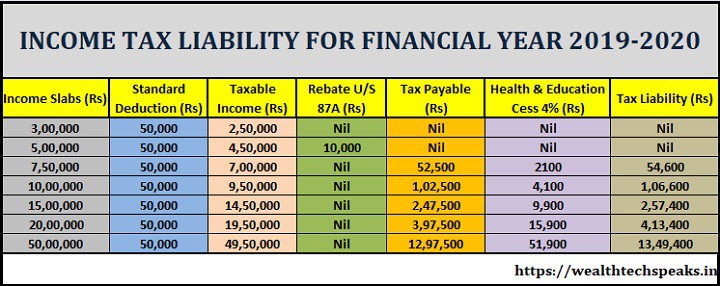

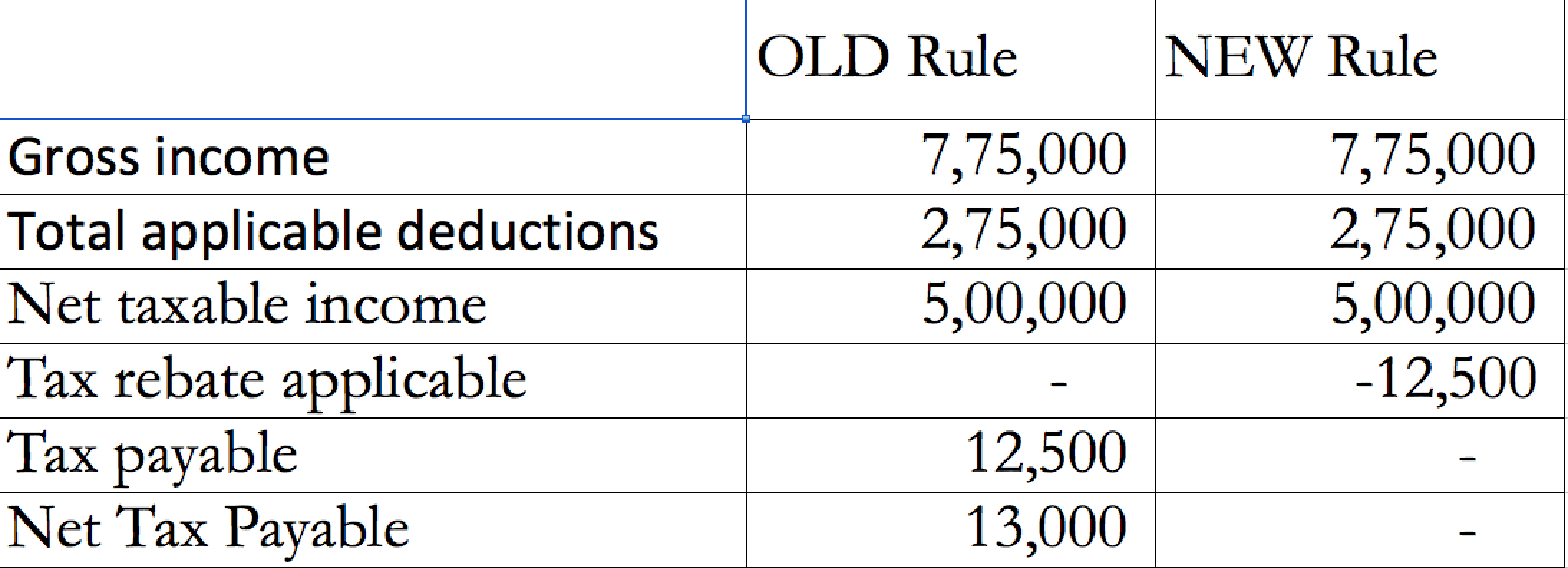

Budget 2019-Is Rs.5 Lakh Income Actually Tax Free? – SMART TAX SAVING & PLANNING – TAX RETURN – TAX2WIN

Muth Encourages Eligible Residents to Apply for Extended Property Tax/Rent Rebate Program - Senator Katie Muth

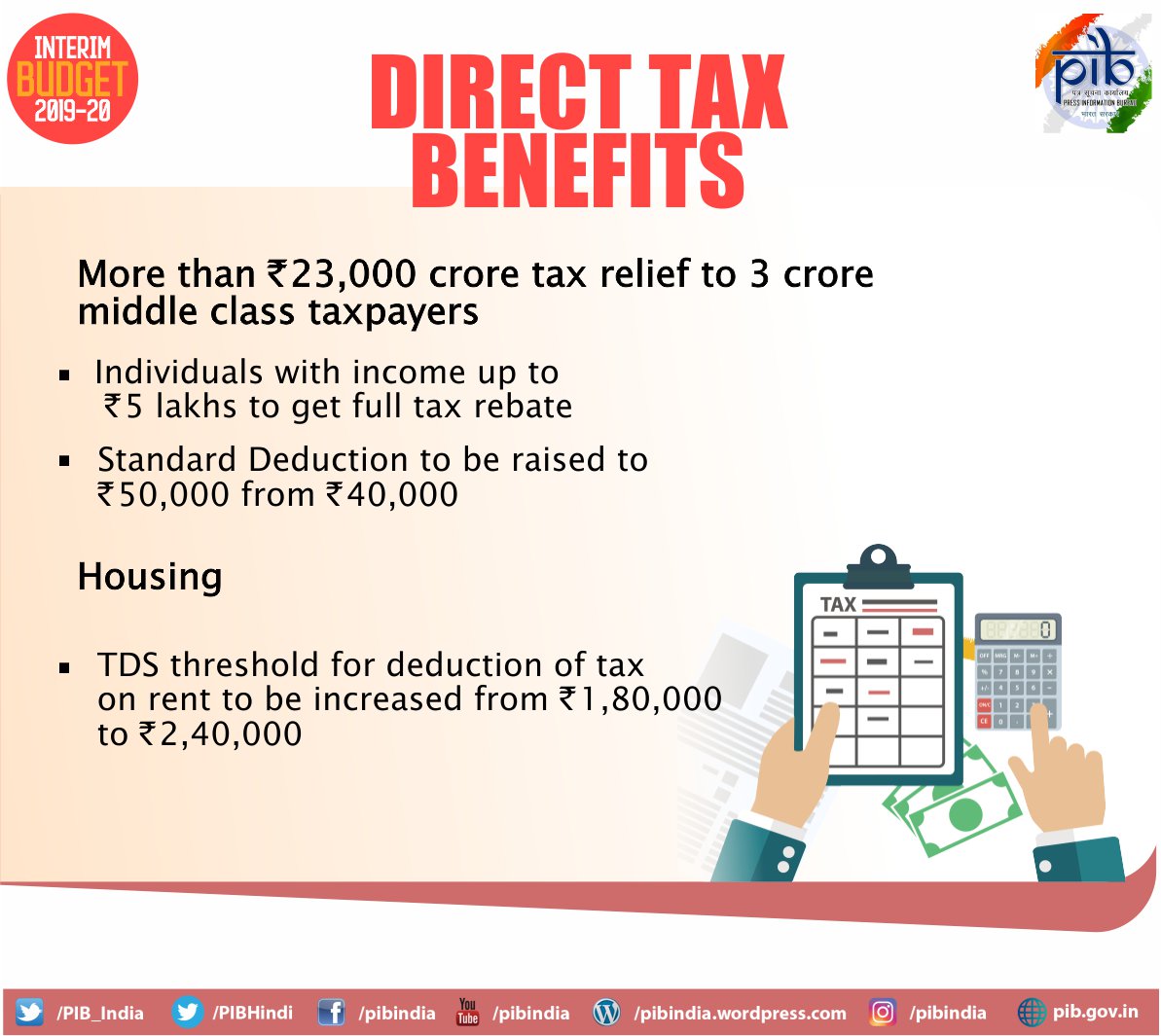

Budget 2019 Personal Finance Highlights: Income tax rebate for those earning under Rs 5 lakh, other benefits | Business News,The Indian Express

PIB India on Twitter: "Individual taxpayers having annual income upto Rs 5 lakhs will get full tax rebate. Individuals with gross income up to 6.5 lakh rupees will not need to pay